Do you own and run a business in Nigeria? If so, in this article we will answer the question of whether indeed you should consider getting your business registered or incorporated with the Corporate Affairs Commission (CAC)[1]. We will also inform you of the various business structures that are currently available in Nigeria so that you take them into consideration when choosing which legal structure best fits your business needs and goals.

It is a surprising fact that many small and medium scale business owners in Nigeria do not consider it important to register or incorporate their businesses. Some of these business owners avoid registering their business because they believe that non-registration ‘protects’ their business from paying taxes. But is this true? We will answer that too.

While controlling or minimizing tax obligations should definitely be a foremost consideration for every business, there is a proper way to go about that. Not registering your business is definitely not part of it. No one wants to shoot himself or herself in the foot. This is exactly what not registering your business is comparable to.

For any progressive business, the advantages of registration (especially using a well-considered business structure) completely outweigh the supposed advantages of not getting registered.

So let’s get to it.

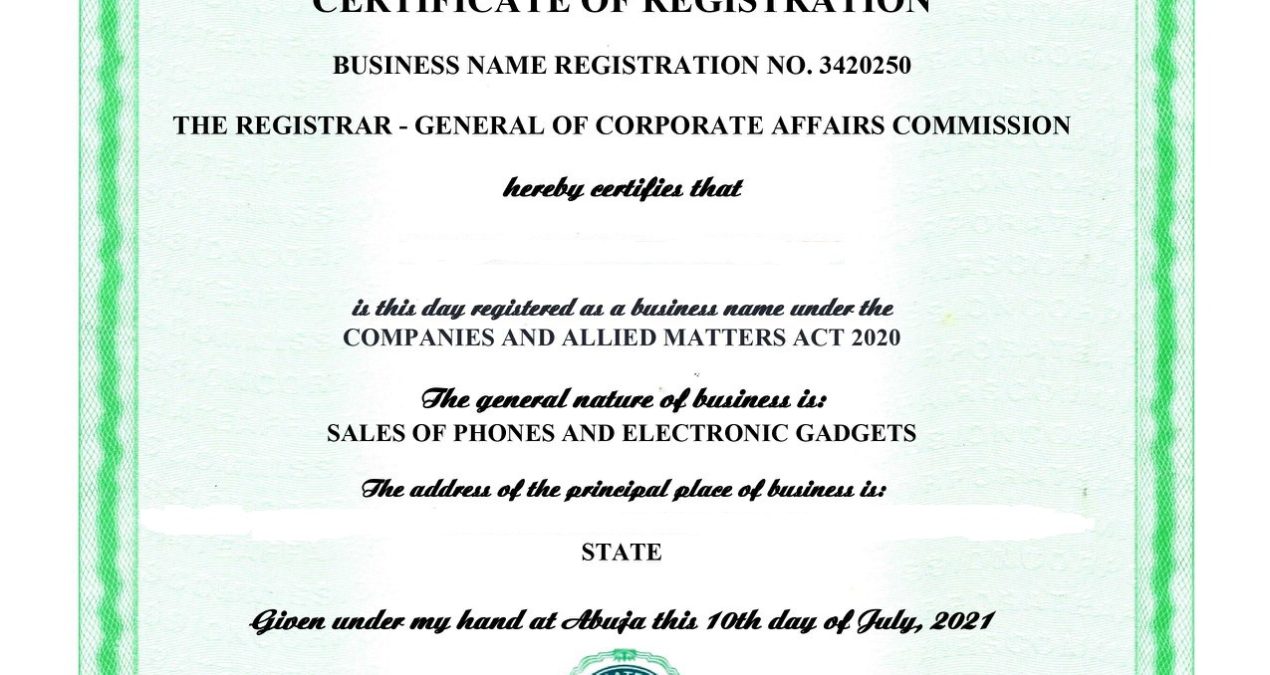

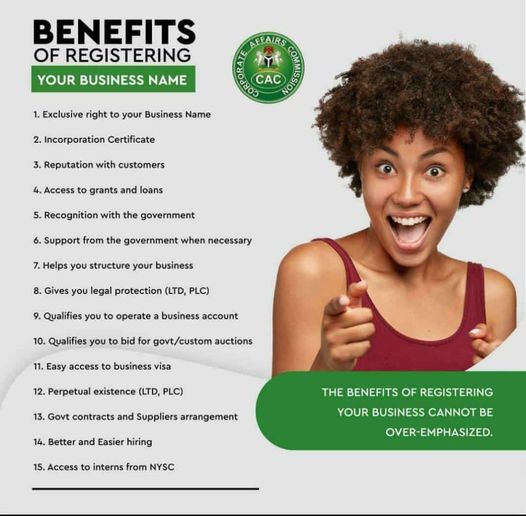

In Nigeria, the benefits of registering your business include the following –

- It is one way to Protect your business name/identity – Now let’s imagine that you run a food business. In recent times your business has been booming and your bank account is in fact swollen to the limits. Your happy customers call and popularly know you as ‘Miss Pepeye’. Your food restaurant is also popularly known as ‘Pepeye Buka’. In fact, once Pepeye buka is mentioned in any part of town, no one argues that it is your business that is being referred to.

If for whatever reason your business is not registered or incorporated with this name (or an identical name) or this name is not trademarked, there exists the risk of a Competitor coming up tomorrow to name its business with the exact same name that you have diligently built your business with over time – Pepeye buka.

So let’s imagine that Mrs Atiku – your competitor who is so jealous, approaches the Corporate Affairs Commission (CAC) to register her own food business with the Name – Pepeye buka. Guess what? If you did not register your business before Mrs Atiku’s move, there is nothing stopping her from succeeding with her move. She could get her own ‘Pepeye Buka Enterprises (or Nig Ltd)’ registered with the CAC; in effect successfully using the same name everyone knows you and your business by. And the result would be? Mrs Atiku would automatically become the ‘legally recognized’ owner of the business entity legally recognized by that name and all your hard-work in building the ‘Pepeye Buka’ brand and getting the goodwill of customers will be ascribed to Mrs Atiku.

The point from our story here is – registering/incorporating your business is a major step towards legally maintaining exclusive use of the name you have given your business. Every business person knows how important branding can be. Once people get to know your business name (or brand) and attach goodwill and loyalty to it, the next most important thing is to prevent competitors from using that name or brand without your permission. In effect, registering your business is the first step to making your business identity exclusively yours and unique to you. No second business can validly be registered with the Corporate Affairs Commission using your business name once your business is registered/incorporated. For a second business to be registered with the same name, they would need your consent to do so. Section 852 of the Companies and Allied Matters Act

Registering your business even keeps competitors away from using a name that is identical or very similar to your business’ name. This is to prevent a situation where a competitor uses a name nearly resembling your business’ name for the purpose of outsmarting customers into thinking both businesses are owned or operated by the same person.

- It helps you Set up a proper legal structure for your business – Registration helps you choose a legal structure that is best suitable for the long term growth and sustenance of your business. Therefore, you could choose to register your business as a business name, a limited liability company, a public liability company etc. Each of these structures are different and have their different legal implications. Building a business is almost identical to building a house. No matter how beautiful the exterior of a house is, its most important part is actually its foundation. Same thing with registering your business. When your business is registered with the Corporate Affairs Commission, you are able to structure your affairs properly.

- It helps you Separate your business liability from your personal liability – Proper registration can help you separate your business liability from your personal liability. This effect (or concept if you would) of separating your business liability from your personal liability is called ‘limited liability’. Big grammar? I’ll break it into molecules. Liabilities of a business are simply what the business owes. While running a business, most times the business incurs debts. Suppliers, employees and maybe more persons could be owed. Now, you would not want these debts arising from the business to cross into your personal account. Put differently, you would not want to be personally liable for the debts of your business.

In effect, it is best that business liabilities should remain as such while your personal liabilities remain absolutely different. You don’t want any situation where like an evil spirit, your business debts roam into your personal account and swallow all the money there. This means you want any future liabilities from the business to be ‘limited’ to the business. Registering your business as a Company helps your achieve this.

So that, when the loans were gotten by the company and in the worst case possible, the company is unable to repay these loans, all steps at recovering the debt will ‘generally’ be limited to the Company’s assets[2]. This is because of the limited liability concept.

The opposite or reverse of the limited liability concept is ‘unlimited liability’. Unlimited liability applies when the business is not registered and when it is registered as a business name. In effect, not all types of registered business entities enjoy limited liability. When liability is unlimited, there is no separation between business losses and the losses of its owners.

A simple illustration may be able to drive home this point better;

Lets imagine that you took a loan from the bank to start your mechanic business. Contrary to your projections, your business did not perform so well and your plans went south. The situation even becomes worse because due to the business problems, you are behind on your loan repayments and you now owe the bank.

Since the loan is in your name (or even when you took it using a business name), you are personally and fully responsible (liable) for repaying the loan. If the Bank sues, the bank may be authorized by the Court to take over any properties (assets) that are in your name (like your house and land) and sell them to recover the loan amount you are owing. This is a clear instance of “unlimited liability”. In this situation, your personal assets are at risk and business failure could lead to personal bankruptcy.

The reverse is the case where the liability is limited.

Thankfully, under the current CAMA 2020, one person can register a Company. This means, even though you are the only Director in the Company, by law, you are different from the Company. With this structure, and a proper management of the legal risks of the Company, your personal assets – such as your house and car, would be save from business debts (or liabilities).

- Registration Enables you Earn trust of Clients/Customers; People and other businesses generally find it easier to do business with a registered business. This is because a registered business has rights and duties under the law, and this will give them (especially new clients/customers) the confidence that they are transacting with a reputable entity. Registration also helps you gain business credibility when dealing with business investors or financiers as well as bigger companies. Most big investors don’t usually like dealing with one-man enterprises that have no projection towards achieving growth. Registering your business shows the existence of that projection.

- Registration helps ensure business continuity; on this benefit, it is important to note that when a business is registered as a company, the Law considers the Company to be a different and separate legal entity from its owners/founders. Due to this, the Company can enter into contracts, buy properties and own properties too. This separation of the company from its owners means that the Company can continue to exist even when its original founders and owners are long dead. Also, since the company is an entity in itself, it is possible for its directors to change over time so that the business continues. This is usually not the case with one-man enterprises where the business is so connected to the its founder that if the founder for any reason is missing in action, the business is missing as well.

An example here might help make this point clear. First Bank of Nigeria was established in 1894, it is unimaginable to believe that the founders of the Bank are still alive. But even with their demise long ago, First Bank continues to exist as a going business concern.

“Proper Business registration can give your business long life”

To show how far reaching this benefit is, when a company runs into serious troubled waters, since it is in the eyes of the law a legal person, there are various legal means of saving the company or preventing its death (that is keeping it from going bankrupt). These means of keeping the company (and its business) alive are called ‘company restructurings’[3]. As a restructuring option, the failing company can be bought over by a more profitable one. It can even ‘marry’ [in legal parlance ‘merge with’] a more successful company and remain in business as a new company or a part of the more successful company. When the former Diamond Bank headed into a bit of business strain, Access bank bought it over and so the customers of the Bank and business (previously operated as Diamond Bank) was absorbed into Access Bank and business continued.

- Easier Access to loans, business grants and Government incentives; As a registered business, it is relatively easier to access loans to start or expand your business operations. This is because as mentioned earlier, more established businesses and even government establishments (in many cases) find it easier to trust and do business with registered businesses. An example of government grant that was available to only registered businesses was the recent Federal Government payroll support for SMEs to help caution the devastating effects of the pandemic on these businesses.

- Helps you comply with the laws applicable in regulated industries/Business Sectors – most times registering your business is compulsory. This is because, there are industries and businesses that by law, you cannot undertake without properly registering a company. Because of how sensitive these industries and businesses are, it is actually compulsorily required that only registered companies run these kind of businesses. Examples of such businesses are the banking and insurance businesses. Before anyone can set up and run an insurance business or Banking business in Nigeria, the law compulsorily requires that a company is registered for that purpose. ‘Ever wondered why you have not seen a bank in Nigeria called Okorodichukwu & Sons Enterprises yet?’

The benefit of registering the business in an instance like this is that it helps you comply with government regulations governing your business so as to prevent your business operations from being shut down by the government.

- Can open a business bank account – Usually before a Bank will accept to open a Bank account in the name of your business or enterprise, the Bank will ask for the registration/incorporation documents of your business. It is not arguable that using a corporate account for your business strengthens the trust, confidence and credibility of your business before clients/customers, bank and partners. Besides using a corporate account looks professional and beats using a private account. But to get one, you need to register your business with the Corporate Affairs Commission.

For further inquiries or clarifications on this piece – you can us chat up via; http://wa.me/+2347083595771 or Call us on +2347061432534.

[1] In this article we use the words ‘incorporate’ and ‘register’ interchangeably to refer to the process of having your company legally recognized and identified by the Corporate affairs commission

[2] There are cases where this is not the case, that is to say, recovering a debt many tap into the personal assets of the Company’s owners or directors. This could happen where the Company directors sign person guarantees to get the loan and when the personal properties of the company directors are used as collateral for the loans.

[3] https://www.investopedia.com/terms/r/restructuring.asp